Clinical laboratories (referred to in shorthand as “clinical labs”) are healthcare facilities wherein healthcare professionals such as pathologists and laboratory technologists extract and/or analyze samples of biological specimens collected from patients, typically bodily fluids (e.g., blood, urine, cerebrospinal fluid) and tissues, to help diagnose conditions.1 Clinical labs are usually located in hospitals, in physician offices, or in an independent setting.2 Further, these laboratories can generalize and provide common diagnostic laboratory tests or they can specialize in certain disease-specific diagnostic and confirmatory tests or certain types of tests, including:

-

Clinical Chemistry;

-

Clinical Microbiology;

-

Hematology;

-

Blood Banking and Serology (a/k/a transfusion medicine);

-

Clinical Microscopy;

-

Histopathology and Cytopathology;

-

Molecular Biology; and,

-

Public Health (e.g., water analysis, testing for environmental substances, other tests related to public and environmental health).3

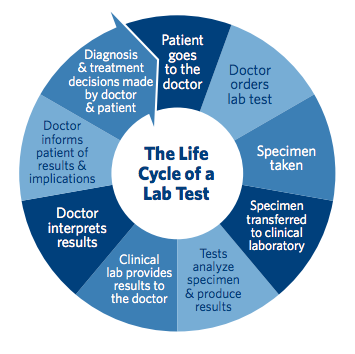

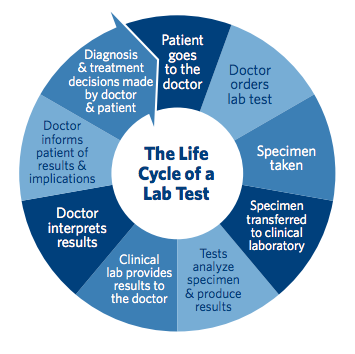

The typical process for a lab test is set forth below in

Exhibit 1.

Exhibit 1: Lab Test Life Cycle 4

Several types of facilities may provide clinical lab testing, including: hospitals, physician offices, and independent laboratory providers. Recently, independent medical laboratories have gained market share, accounting for 42% of the U.S. medical laboratory testing market (hospitals account for approximately 55% and physician offices for about 4%).5 Over the past half-decade, the industry has seen increased competition from hospital outreach programs and physician insourcing.6 However, the increasing demand for clinical lab testing is anticipated to result in a shortage of clinical lab services, negating any competitive concerns among providers.

Clinical labs are integral to the healthcare sector, as approximately 70% of medical decisions depend on laboratory test results.7 The principal demand driver for this industry is the aging Baby Boomer population and their high prevalence of chronic illnesses (approximately 78% of Americans age 55+ have one or more chronic illnesses8), which require frequent testing and routine monitoring.9

These labs have experienced increased demand from the COVID-19 pandemic, wherein testing was vital to controlling the virus’s spread.10 While the frequency of testing has receded, the demand for COVID-19 testing may continue as various businesses require COVID-19 testing to return to work upon experiencing symptoms and for patients prior to undergoing medical procedures. Further, with the increasing prevalence of other respiratory viruses (e.g., influenza and RSV),11 clinical labs may play a significant role in testing for these viruses as well. However, the potential for these labs to expand and meet this demand will likely be restricted by the amount of staff available to analyze the tests.

According to the Centers for Medicare & Medicaid Services (CMS), there are approximately 279,000 CLIA-certified laboratories in the U.S.12 Industry revenue grew at an annual rate of 1.6% between 2017 and 2022, and industry analysts expect revenue to grow between 2.5% and 6.4% annually over the next few years.13 Further, industry consolidation has bolstered profitability in the industry as laboratories have collaborated with hospitals that lack in-house testing.14 This increased demand has surpassed the supply of skilled laboratory employees, as the aging workforce has caused a shortage in the sector coupled with fewer individuals pursuing these healthcare professions.15 The National Accrediting Agency for Clinical Laboratory Sciences reports that an estimated 7,000 new laboratory jobs are needed annually, but only 6,000 new graduates are entering the industry each year, resulting in an estimated shortage of 1,000 laboratory professionals each year.16 Moreover, the U.S. Department of Labor reports that only a third of these professionals are being trained, exacerbating the shortage.17

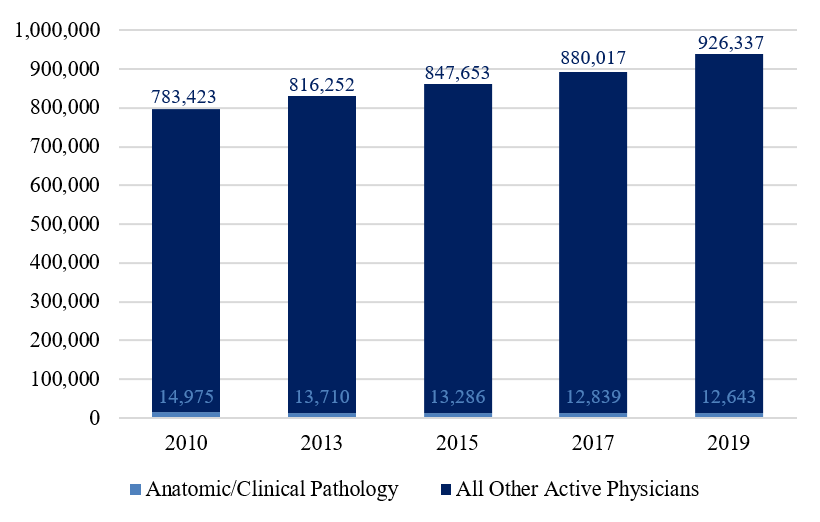

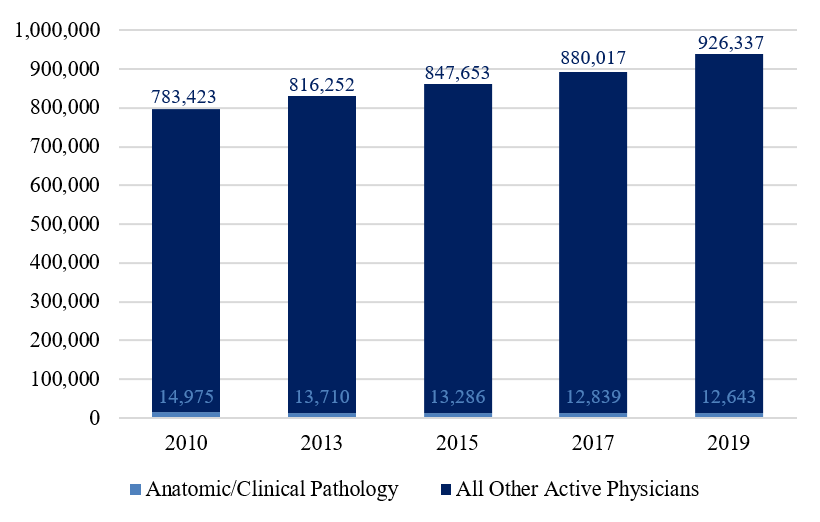

As demand for clinical lab testing rises, the need for pathologists – physicians specialized in disease diagnosis utilizing laboratory analysis – is likely to also increase. As set forth in the below exhibit, the number of pathologists practicing in the U.S. has decreased 1.9% per year since 2010, despite the number of active physicians in general increasing 1.9% annually.18 Nevertheless, pathology remains the 17th most popular specialty of all physicians.19

Exhibit 2: Physician Supply by Self-Designated Specialization, 2010-201920

Compounding the issue of the declining pathology workforce is the proportion of the current pathology workforce nearing retirement – as of 2020, over two thirds of pathologists were age 55 or older.21 According to a physician workforce analysis published by the Association of American Medical Colleges (AAMC) in March 2016, physicians typically retire at the age of 67.22 Accordingly, over half of the pathology workforce may retire in the next 10 years.

One factor that may contribute to a potential shortage of pathologists is the lack of available residency positions in the specialty. In 2022, 994 medical students competed for just 631 pathology residency positions.23 If the current trend of new entrants remains stable, then the next ten years may see more pathologists retiring than entering the workforce, causing the total supply to shrink while demand continues to grow, which may result in a shortage.

Considering the seemingly inevitable gap between supply and demand, clinical labs may face some challenges in the coming years. With the growth in the Baby Boomer population, a significant portion of whom have one or more chronic conditions, clinical labs may greatly benefit from the potential associated rise in demand. However, a clinical lab’s ability to meet this demand may be hindered by the shortage of pathologists and other laboratory professionals. Therefore, clinical labs that are positioned to adopt rapidly-advancing technology may be able to utilize technology to automate some manual work in order to thwart any workforce shortage. Further, in some industries, a gap between supply and demand may lead to increased prices, but with the U.S. healthcare system’s third-party payor system, in which the government has an outsized influence, the typical supply-demand dynamic does not affect prices. The next installment of this two-part series will cover the reimbursement and technological environments for clinical labs.

“54138 Laboratory Testing Services in the US Industry Report” By Thi Le, IBISWorld, July 2022, p. 7.

“Clinical lab Services Payment System” Medicare Payment Advisory Commission, Payment Basics, November 2021, https://www.medpac.gov/wp-content/uploads/2021/11/medpac_payment_basics_21_clinical_lab_final_sec.pdf (Accessed 11/16/22), p. 1.

“Clinical lab”, By Marlon L. Bayot, et al., StatPearls, available at: https://www.ncbi.nlm.nih.gov/books/NBK535358/ (Accessed 11/16/22).

“Importance of Clinical Lab Testing Highlighted During Medical Lab Professionals Week” American Clinical lab Association, April 17, 2014, https://www.acla.com/importance-of-clinical-lab-testing-highlighted-during-medical-lab-professionals-week/ (Accessed 11/16/22).

Le, IBISWorld, July 2022, p. 30.

“Strengthening Clinical Laboratories” Centers for Disease Control and Prevention, November 15, 2018, https://www.cdc.gov/csels/dls/strengthening-clinical-labs.html (Accessed 11/16/22).

“Percent of U.S. Adults 55 and Over with Chronic Conditions” Centers for Disease Control and Prevention, https://www.cdc.gov/nchs/health_policy/adult_chronic_conditions.htm (Accessed 11/16/22).

Le, IBISWorld, July 2022, p. 7.

“A ‘Tripledemic’? Flu, R.S.V. and Covid May Collide This Winter, Experts Say” By Apoorva Mandavilli, New York Times, October 23, 2022, https://www.nytimes.com/2022/10/23/health/flu-covid-risk.html (Accessed 11/16/22).

“Provider of Services File – Clinical Laboratories” Centers for Medicare & Medicaid Services, Q3 2022, https://data.cms.gov/provider-characteristics/hospitals-and-other-facilities/provider-of-services-file-clinical-laboratories (Accessed 11/16/22).

Le, IBISWorld, July 2022, p. 7; “Insights on the Clinical Laboratory Services Global Market to 2026 - Key Motivators, Restraints and Opportunities” Research and Markets, July 2, 2021, https://www.globenewswire.com/en/news-release/2021/07/02/2256988/28124/en/Insights-on-the-Clinical-Laboratory-Services-Global-Market-to-2026-Key-Motivators-Restraints-and-Opportunities.html (Accessed 11/16/22).

Le, IBISWorld, July 2022, p. 7.

“Active Physicians in the Largest Specialties” 2020 Physician Specialty Data Report, Association of American Medical Colleges, https://www.aamc.org/data-reports/workforce/report/physician-specialty-data-report (Accessed 11/16/22).

Ibid. HCC referenced the 2020, 2018, 2016, 2014, and 2012 versions of this report.

“The Complexities of Physician Supply and Demand: Projections from 2014 to 2025” By Tim Dall et al., IHS Inc., Report for Association of American Medical Colleges, April 5, 2016, available at: https://www.researchgate.net/publication/331556062_2016_Update_The_Complexities_of_Physician_Supply_and_Demand_Projections_from_2014_to_2025_Final_Report_Association_of_American_Medical_Colleges/link/5c7fe344458515831f8afc17/download (Accessed 11/16/22), p. 34. The report specifies that in a given cohort of male physicians, 50% of the physicians in the cohort are likely to be retired at the age of 67. The report further specifies that female physicians exhibit similar retirement patterns.

“Results and Data: 2022 Main Residency Match” National Resident Matching Program, April 2022, https://www.nrmp.org/wp-content/uploads/2022/11/2022-Main-Match-Results-and-Data-Final-Revised.pdf (Accessed 11/16/22), p. 2.