On August 31, 2024, the California legislature passed a bill that may curb private equity (PE) healthcare transactions in the state.1 The legislation is now on Governor Gavin Newsom’s desk for signature, who must sign or veto the bill by September 30, 2024. If signed into law, California will have the strictest regulation of PE deals of any state in the country. This Health Capital Topics article discusses the new law and reviews the status of both state and federal regulation of PE.

While PE is not altogether new to healthcare, its involvement in the sector has increased significantly over the last decade. This renewed interest has been attributed to a number of factors, including low interest rates, the “increasing commercialization” of healthcare, and the healthcare industry’s failure to deliver high quality care (with Americans experiencing worse health outcomes than all other industrialized nations, despite higher spending).2 From 2010 to 2019, there were approximately $750 billion in PE healthcare deals, and in 2023 alone, over 780 PE healthcare deals were announced or closed.3 In a ten-year period, PE acquisitions of just physician practices increased sixfold, from 75 deals in 2012 to 484 deals in 2021.4

The California State Assembly and State Senate passed Assembly Bill (AB) 3129 by a fairly wide margin (21-11 in the Senate and 49-14 in the Assembly).5 The bill regulates transactions wherein a PE group or hedge fund “establishes a change in governance or sharing of control over health care services provided by a health care facility, provider group, or provider doing business in [California],” or “otherwise assumes direct or indirect control.”6 In general, the bill requires that, starting January 1, 2025, transactions involving most types of healthcare organizations generating $25 million or more in gross annual revenue receive approval from the California Attorney General.7 The Attorney General is to review the transaction “to determine if the transaction may have a substantial likelihood of anticompetitive effects and what mitigation measures could be adopted to avoid this result,” and approve, conditionally approve, or deny the transaction.8

Notably, the following transactions are exempt from review:

Transactions between a PE group/hedge fund and a nonphysician provider or a provider (defined as “a group of two to nine licensed health professionals”) with gross annual revenue of $4 million or less; and

Transactions involving for-profit hospitals.

9

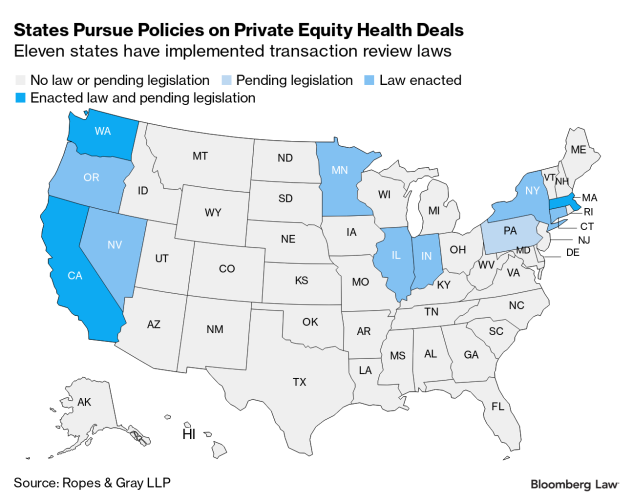

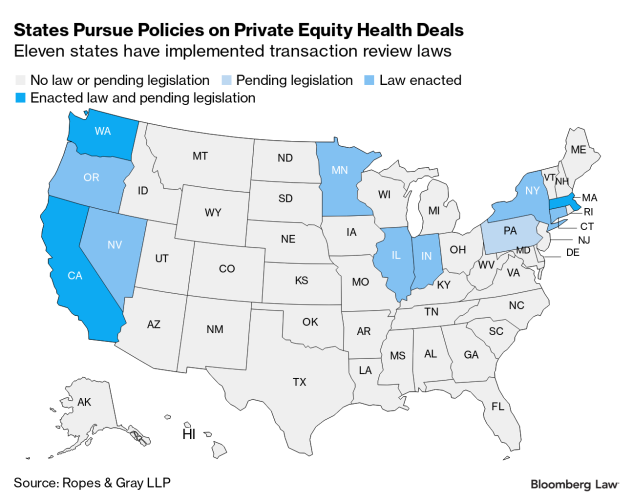

AB 3129 is not the first California law to require oversight of PE deals. In 2022, California enacted a requirement that healthcare investments be reviewed by the newly-created Office of Health Care Affordability.10 With the passage of AB 3129, California now has the strictest regulation of healthcare PE investment in the U.S.11 However, the passage of this bill is part of a wider trend across states, and within the federal government, to increase transparency and control costs, particularly where PE is involved, in the healthcare industry. As illustrated in the below map, 11 states have laws on the books that require some level of review over certain healthcare transactions.12 For example, Oregon enacted a law similar to AB 3129 in 2022. While the legislation has not yet resulted in any blocked transactions, over a quarter of reviewed transactions were conditionally approved, such as requiring the organization to stay in-network for Medicaid post-transaction.13

In July 2024, the Health Over Wealth Act was introduced in the U.S. Senate, which would require PE and other for-profit health services providers to disclose certain financial and operational data and to create an escrow account to cover essential health services costs for five years in the event that its facility closes.14 The Act would also give the U.S. Department of Health and Human Services (HHS) significantly more power to regulate and block PE deals across the U.S. However, as of the publication of this article, that bill has not yet advanced.15 Additionally, the Senate Homeland Security Committee announced in April 2024 that it was launching an inquiry into whether expanding PE control over hospital emergency departments is endangering patient care and emergency preparedness.16 In December 2023, the Senate initiated a bipartisan investigation into PE involvement in the healthcare industry, reaching out to a number of healthcare providers and PE groups to request information.17 In addition to congressional action, the executive branch has taken a number of steps over the past few years to garner more information regarding, and increase transparency related to, PE moves in the healthcare space, especially as relates to competition in healthcare. For example, in March 2024, the Department of Justice’s (DOJ’s) Antitrust Division, the Federal Trade Commission (FTC), and HHS announced the launch of a multi-agency inquiry – in the form of a request for information (RFI) and public workshop – focusing on the increasing control of PE and other corporations over the healthcare industry.18

Detractors of AB 3129, and similar legislation in other states, argue that the increased complexity and scrutiny may result in reduced healthcare investment in the state, while proponents assert that such regulation is necessary to ensure the provision of high-quality, lower-cost medical care, given PE’s increasing role in the U.S. healthcare delivery system.19 A number of studies have found that PE acquisition of healthcare service providers have resulted in higher healthcare costs, lower quality of care, and poorer financial outcomes for those acquired entities.20 Whether California’s new law will be a harbinger of future state action, or incentivizes Congress to pass a law empowering the federal government to regulate PE deals at a national level, remains to be seen.

“Update: AB 3129 Passes in California Senate and Nears Finish Line” By Julia D’Errico, et al., Sheppard Mullin Richter & Hamilton LLP, September 9, 2024, available at: https://www.jdsupra.com/legalnews/update-ab-3129-passes-in-california-6487576/ (Accessed 9/23/24).

“Private Equity’s Role in Health Care” The Commonwealth Fund, November 17, 2023, https://www.commonwealthfund.org/publications/explainer/2023/nov/private-equity-role-health-care (Accessed 9/5/24); “U.S. Health Care from a Global Perspective, 2022: Accelerating Spending, Worsening Outcomes” By Munira Z. Gunja, Evan D. Gumas, and Reginald D. Williams II, The Commonwealth Fund, January 31, 2023, https://www.commonwealthfund.org/publications/issue-briefs/2023/jan/us-health-care-global-perspective-2022 (Accessed 9/5/24).

“California Takes Lead on Regulating Private Equity Health Deals” By Celine Castronuovo, Bloomberg Law, July 9, 2024, https://news.bloomberglaw.com/health-law-and-business/california-takes-lead-on-regulating-private-equity-health-deals (Accessed 9/5/24); “Soaring Private Equity Investment in the Healthcare Sector: Consolidation Accelerated, Competition Undermined, and Patients at Risk” By Richard M. Scheffler, Laura M. Alexander, and James R. Godwin, May 18, 2021, available at: https://bph-storage.s3.us-west-1.amazonaws.com/wp-content/uploads/2021/05/Private-Equity-I-Healthcare-Report-FINAL.pdf (Accessed 9/5/24), p. 2; “PE braces healthcare services deals as add-ons fall” By Jessica Hamlin, PitchBook, February 13, 2024, https://pitchbook.com/news/articles/pe-braces-healthcare-services-deals-as-add-ons-fall (Accessed 9/5/24).

The Commonwealth Fund, November 17, 2023.

“AB-3129 Health care system consolidation (2023-2024)” Section 1190(a)(1), California Legislative Information, available at: https://leginfo.legislature.ca.gov/faces/billCompareClient.xhtml?bill_id=202320240AB3129&showamends=false (Accessed 9/5/24).

“California Senate Passes Bill to Clamp Down on Private-Equity Healthcare Deals” By Chris Cumming, Wall Street Journal, September 4, 2024, https://www.wsj.com/articles/california-senate-passes-bill-to-clamp-down-on-private-equity-healthcare-deals-118a2134 (Accessed 9/5/24).

Section 1190.10(h)(7)(B), California Legislative Information.

“California Senate Passes Bill to Clamp Down on Private-Equity Healthcare Deals” By Chris Cumming, Wall Street Journal, September 4, 2024, https://www.wsj.com/articles/california-senate-passes-bill-to-clamp-down-on-private-equity-healthcare-deals-118a2134 (Accessed 9/5/24).

Castronuovo, Bloomberg Law, July 9, 2024; “Health Care Transactions Laws – An Interactive Map” Ropes & Gray, https://www.ropesgray.com/en/sites/healthcare-transactions-laws (Accessed 9/5/24).

“California weighs blocking private equity health deals” By Maya Goldman, Axios, August 22, 2024, https://www.axios.com/2024/08/22/california-private-equity-health-deals (Accessed 9/5/24).

“Sen. Markey offers bill to block private equity deals in health care” By Dan Primack, Axios, April 4, 2024, https://www.axios.com/2024/04/04/sen-markey-offers-bill-to-block-private-equity-deals-in-health-care (Accessed 9/5/24).

The bill has been referred to the Committee on Finance. S.4804 - Health Over Wealth Act, Congress.Gov, https://www.congress.gov/bill/118th-congress/senate-bill/4804/all-actions (Accessed 9/5/24).

“Senate to examine private equity's growing role in ER care” By Peter Sullivan, Axios, April 3, 2024, https://www.axios.com/2024/04/03/senate-private-equity-health-care (Accessed 9/5/24).

“Senators launch bipartisan probe of private equity's growing role in U.S. health care” By Gretchen Morgenson, NBC News, December 6, 2023, https://www.nbcnews.com/politics/congress/senators-grassley-whitehouse-probe-private-equity-us-health-care-rcna128070 (Accessed 9/5/24).

“Justice Department, Federal Trade Commission and Department of Health and Human Services Issue Request for Public Input as Part of Inquiry into Impacts of Corporate Ownership Trend in Health Care” Office of Public Affairs, Department of Justice, March 5, 2024, https://www.justice.gov/opa/pr/justice-department-federal-trade-commission-and-department-health-and-human-services-issue (Accessed 9/5/24); “Request for Information on Consolidation in Health Care Markets” Department of Justice, Department of Health and Human Services, Federal Trade Commission, February 29, 2024, https://content.govdelivery.com/attachments/USDOJOPA/2024/03/05/file_attachments/2803589/DOJ-FTC-HHS%20HCC%20RFI%20-%2003.04.24%20-%20FINAL.pdf (Accessed 9/5/24).

Cumming, Wall Street Journal, September 4, 2024.

Castronuovo, Bloomberg Law, July 9, 2024.