The value of a non-compete clause (NCC) in a physician employment agreement (PEA) arises from the restriction placed upon the employed physician by the NCC.1 In the absence of the arrangement, the physician would be free to provide professional medical services to patients regardless of the time period or geographic location. When a physician has entered into a PEA with an NCC, the physician is restricted in their ability to provide professional medical services at sites of service which are deemed as competitors to the employing entity.

These restrictions can be viewed from both a physician (seller) and the employing entity (buyer) perspective. From the physician’s perspective, the NCC limits the physician’s ability to provide services. A reasonable methodology for determining the amount that a physician (willing seller) would demand to enter into an agreement with an NCC might be to determine the magnitude of the lost profits, on a present value basis, that would likely arise from the physician’s post-employment restricted practice. However, this methodology is hampered by regulatory restrictions, such as the Stark Law and Anti-Kickback Statute, which forbid an employing entity from paying physicians for the volume or value of referrals.2 An overzealous regulator may misconstrue an arrangement to pay a physician for an NCC as an impermissible payment to acquire a stream of referrals, i.e., the business that would have been performed at a competitor’s site of service, except for the NCC.3 Owing to these concerns regarding the misinterpretation of the payment for an NCC, a risk averse party to a transaction of this sort would be disinclined to employ a valuation methodology based upon lost profits to the physician.

Alternatively, the value of an NCC can be analyzed from the perspective of the employing entity (willing buyer). It is reasonable to conclude that an employing entity entering into a PEA that includes an NCC would expect to derive an economic benefit arising from the NCC.4 The NCC provides the employing entity with an additional restriction; one that is binding post-employment, which, at the margin, would tend to reduce the likelihood that an employed physician would terminate the employment contract early.

Physician turnover, i.e., the rate of separation of employed physicians,5 can be a significant expense to an employing entity. All relevant factors being constant, an increase in the turnover rate leads to a more frequent incurrence of expenses related to the hiring and on-boarding of new physicians (hereinafter referred to as “RECRUITMENT COSTS”).6 Accordingly, a reduction in the probability of a physician terminating a PEA early would tend to reduce the physician turnover rate and reduce the RECRUITMENT COSTS, a reduction for which a rational economic actor would be willing to pay to achieve.

RECRUITMENT COSTS can be estimated using a build-up approach that separately identifies each of the costs that would likely be incurred by an employing entity in attempting to replace the departing physician.7 These expenses may include:

Fees to outside recruiting firms;

The opportunity cost of the firms staff time expended on recruiting efforts;

Lost productivity between the time when the physician departs and a new physician is hired; and,

Lost productivity during the ramp-up period for the new physician until full productivity is reached.

The cost savings arising from the differential in expected RECRUITMENT COSTS resulting from the reduced probability of a physician choosing to terminate a PEA early forms the foundation of a valuation methodology that is independent of any consideration of the volume or value of physician referrals. In its essence, this methodology is derived from a with and without analysis8 that attempts to quantify the expected expenses to be incurred by the employing entity both with and without an NCC. The difference in expected RECRUITMENT COSTS, i.e., the expected RECRUITMENT COSTS without the NCC minus the expected RECRUITMENT COSTS with the NCC, will equal the savings (economic benefit) accruing to the employing entity related to the NCC.

The calculation of the expected RECRUITMENT COSTS is complicated by the uncertainty as to the timing of a possible early employment termination by an employed physician. A decision tree analysis can be employed to calculate the impact of the uncertainty related to the timing of the expected RECRUITMENT COSTS.9 The decision tree analyzes the arrangement by decomposing the arrangement into discrete ordered events.10 In the case of an NCC, the term of the PEA is decomposed into smaller timeframes over which the decision to terminate the PEA might be concluded, and the probability of terminating the PEA (and triggering the employing entity to incur the RECRUITMENT COST) is then estimated. The termination of the PEA effectively divides the potential outcomes within the decision tree into two mutually exclusive events, i.e., terminate or not; therefore, if the probability of termination equals p, then the probability of not terminating the PEA must equal 1 - p.11

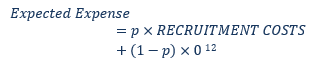

The decision to not terminate the PEA has an associated cost of zero ($0), as this outcome would fail to trigger the RECRUITMENT COSTS; therefore, the calculation of the probability adjusted expected expense for each time period will equal:

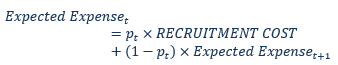

However, if the decision is made to not terminate the PEA in the first contract year, there remains the possibility that the physician will choose to terminate the PEA in the remaining years of the PEA. This result leads to the adjustment of the above equation to account for the potential for the RECRUITMENT COSTS to be realized in any of the selected discrete periods following the current period.

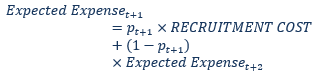

And,

This pattern will repeat until all of the discrete ordered events comprising the PEA are assigned expected expenses. This process is set forth graphically in Exhibit 1, below:

Exhibit 1, beginning on the left hand side, calculates the probability weighted expected expense to be incurred during the first period (see Box X) as equal to the estimated probability of terminating the PEA during the first year (5%), times the anticipated expense ($75,551 as described above), plus the probability of not terminating the PEA during the first year (1 - 5% = 95%), times the expected expense to be incurred during contract years 2 through 5 ($19,782).

The expected expenses to be incurred in contract years 2 through 5 ($19,782) is derived from the expenses expected to be incurred during contract year 3 through 5, and so forth. The derivation of the current period expenses are therefore reliant upon the expected expense throughout the term of the PEA. Therefore, the calculation of the expected expense at the initiation of the PEA must proceed by a backward propagation through the decision tree, i.e., the calculations begin at the final ordered discrete period (Box G in Exhibit 1) and are iteratively calculated backward through the decision tree to the initiation date of the PEA (Box K in Exhibit 1). The amount reported in Box K of Exhibit 1, above ($22,277), therefore represents the expected expenses to be incurred throughout the life of the PEA.

The calculation of the expected expenses set forth in Exhibit 1, above, are premised on the following assumptions:

The PEA does not include an NCC;

The probability of early termination in each period is based upon research

12 that indicates the values for the first three contract years (5%, 10%, and 10%) and the assumption that for years 4 and 5 the probability of termination decreases (back to 5%);

The calculated expected expenses for each period are discounted by ½ period at the risk free rate to reflect the time value of money between the beginning of each period and the date when the RECRUITMENT COSTS are actually incurred. It is assumed that, within a given contract year, the probability of termination is uniformly distributed throughout the year, i.e., it is equally probable to occur at any time within the year; therefore, the mid-year convention is employed; and,

The annual compensation for the employed physician is anticipated to be $750,000.

As discussed above, the calculation of the expected costs to be incurred by the employing entity is only the first step in determining the value of an NCC. Following the with and without analysis, it is the differential in expected costs to be incurred by an employing entity with a PEA, including an NCC in comparison with a PEA without an NCC.

Exhibit 2, below, sets forth a description of the calculation of the expected expenses associated with a PEA that includes an NCC.

As noted above, all things being equal, the probability of early termination would be expected to be less for a PEA that includes an NCC. Consequently, the probabilities of early termination in each period have been halved in Exhibit 2, above. The result is a new expected expense amount of $11,912 (Box K, Exhibit 2) for a PEA with an NCC.

The amount calculated in Exhibit 1, above, can be compared with the amount calculated in Exhibit 2, the difference of which will be the expected reduction in cost to be realized by the inclusion of the NCC in the PEA. In that scenario, $22,277 (Box K, Exhibit 1) minus $11,912 (Box K, Exhibit 2) equals Ten Thousand Three Hundred and Sixty Five Dollars ($10,365); this amount would tend to put a ceiling on the amount that the employing entity would be willing to pay to the physician for the inclusion of an NCC.

Value is the future expectation of economic benefit which will accrue to the owner of a property interest. This economic benefit is typically considered as additional incremental cash flow resulting from the employment of an acquired asset. However, economic benefit can also be derived from the relief from an expense that would be incurred by a purchaser in the absence of the ownership of a property interest, as is the case with an NCC in a PEA. Physician turnover can lead to numerous additional expenses for a healthcare enterprise; consequently, the acquisition of a property interest (such as an NCC to a PEA) may lead to a decrease in the expected expense to be incurred by the acquiring entity. This decrement to the expected expenses for a healthcare enterprise constitutes an economic benefit accruing to the acquiring entity, which can be utilized to develop an indication of value. The decision tree analysis, given certain reasonable assumptions, provides a convenient methodology to calculate: (1) the probability adjusted magnitude of the economic benefit to be derived from the ownership of the NCC; and, (2) the present value, as of a specified date, of the aggregate probability adjusted economic benefit to be derived from the ownership of the NCC.

“Developing Trends in Non-Compete Agreements and Other Restrictive Covenants” By Angie Davis, Eric D. Reicin, and Marisa Warren, ABA Journal of Labor & Employment Law, Vol. 30, 2015, p. 255-272.

“Limitation on certain physician referrals” 42 U.S.C. § 1395nn (2010); “Criminal penalties for acts involving Federal health care programs” 42 U.S.C. § 1320a-7b (2010).

It is important to note that, prior to 2007, non-compete clauses were not widely used due to regulatory restrictions. Phase III of the Stark Law (known as Stark III), modified the physician recruitment exception, which now “Allows practice restrictions that do not unreasonably restrict the recruited physician from practicing in the geographic area served by the hospital.” “Medicare Program; Physicians’ Referrals to Health Care Entities With Which They Have Financial Relationships (Phase III)” Federal Register, Vol. 72, No. 171 (September 5, 2007), p. 51075. Additionally, in 2011, the Office of Inspector General (OIG) of the U.S. Department of Health and Human Services (HHS) issued an advisory opinion affirming HHS’s position on allowing NCCs, as long as they do not “unreasonably restrict the recruited physician’s ability to practice medicine in the geographic area served by the hospital” and are in accordance with applicable state law. “Re: Advisory Opinion No. CMS-AO-2011-01” By Jonathan D. Blum, Deputy Administrator & Director, Center for Medicare, https://www.cms.gov/Medicare/Fraud-and-Abuse/PhysicianSelfReferral/Downloads/CMS-AO-2011-01.pdf (Accessed 8/21/17).

“Non-compete Contracts: Economic Effects and Policy Implications” Office of Economic Policy, U.S. Department of the Treasury, March, 2016, https://www.treasury.gov/resource-center/economic-policy/Documents/UST%20Non-competes%20Report.pdf (Accessed 8/21/17).

“2011 Physician Retention Survey: Benchmarking Physician and Advanced Practitioner Trends” American Medical Group Association and Cejka Search, 2011, p. 5.

“What You Don’t Know Can Cost You: Building a Business Case for Recruitment and Retention Best Practices” By Lori Schutte, MBA, Journal of the Association of Staff Physician Recruiters, 2012, http://www.aspr.org/?696 (Accessed 8/21/17); “A review of Physician Turnover: Rates, Causes, and Consequences” By Anita D. Misra-Hebert, MD, Robert Kay, MD, MBA, and James K. Stoller, MD, MS, American Journal of Medical Quality, Vol. 19, No. 2, 2004, p. 62-63.

“Healthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services” By Robert James Cimasi, MHA, ASA, FRICS, MCBA, AVA, CM&AA, Hoboken, NJ: John Wiley & Sons, 2014, p. 116-117.

“Making Hard Decisions” By Robert T. Clemen, Pacific Grove, CA: Duxbury Press, 1996, p. 67-70.

“Physician Recruitment Trends that Can Help Shape a Successful Strategy” By John Gramer, Recruiting Physicians Today, New England Journal of Medicine Career Center, Vol. 23, No. 1 January/February 2015, p. 2.