On April 7, 2025, the Centers for Medicare & Medicaid Services (CMS) published their 2026 Rate Announcement for Medicare Advantage (MA) and Medicare Part D Prescription Drug Plans.1 For 2026, the payment rate to MA plans will increase 5.06%, the largest increase in the past ten years, and up significantly from the 2.2% rate increase proposed by the Biden Administration.2 This Health Capital Topics article will review the Rate Announcement.

MA plans, also known as Part C plans, serve as a supplement or an alternative to Traditional fee-for-service (FFS) Medicare Part A and Part B coverage, but they are still part of the Medicare program.3 MA was created by Congress to provide seniors an alternative to Traditional Medicare, with an emphasis on treating and managing the health of the whole patient. MA plans are offered to Medicare beneficiaries by Medicare-approved private companies that must follow rules set by Medicare.4 These plans can be advantageous for beneficiaries because they limit out-of-pocket costs for covered services (although out-of-pocket costs vary by plan) and may cover additional healthcare services (e.g., fitness programs, vision, dental, hearing) as well as other benefits (e.g., transportation to appointments, drugs/services that promote wellness).5 However, to manage costs, an MA plan’s network is often much narrower than that of Traditional Medicare. Likely due to these benefits, MA plan enrollment has increased steadily over the past two decades, at a much faster pace than Traditional Medicare.6 As of 2024, 32.8 million Americans – 54% of all eligible Medicare beneficiaries – were enrolled in an MA plan.7

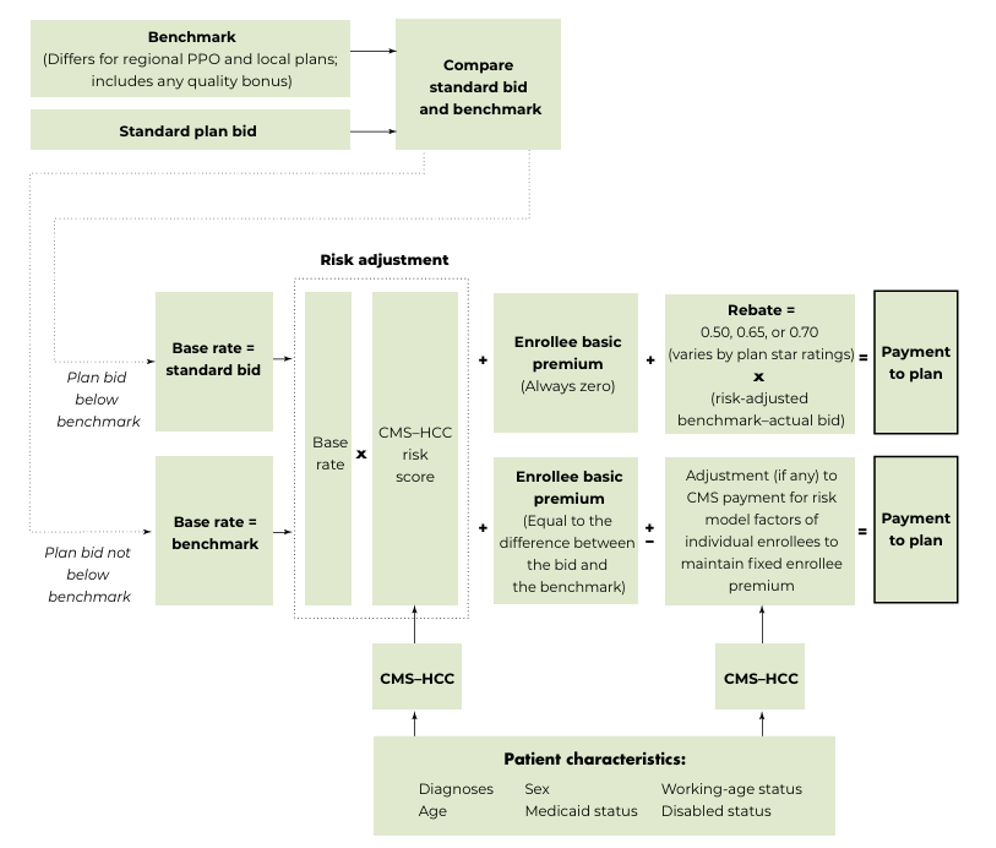

MA plans are reimbursed differently by Medicare depending on the category of the plan. Local MA plans (a type of MA plan that can take a number of different forms, and serve one or more counties8) are reimbursed a fixed amount (capitated payment) per month. That amount is determined annually, based on a combination of:

The plan’s annual bid, in which they propose to Medicare the amount it would take to cover an average beneficiary, including administrative costs and the plan’s profit;

The bid is compared to the local benchmark, which looks at average FFS spending per Medicare beneficiary in each county. Plans are then assigned to a benchmark based on FFS spending in the subject counties in the previous year (those counties with higher spending are assigned lower benchmarks);

The plan’s Medicare star ratings; and,

The plan’s patient geographic and health risk characteristics.

9

The below Exhibit 1 illustrates the methodology.10

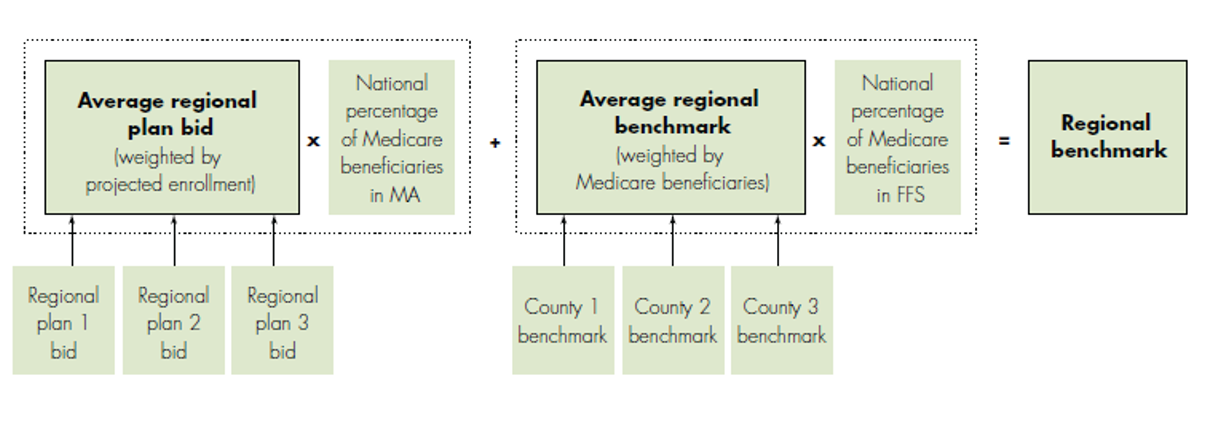

The payment methodology for regional MA plans (preferred provider organizations that serve all of a region designated by CMS11) is more complex in that the benchmark formula includes the bids submitted by MA plans, as shown in the below Exhibit 2.12

Notably, although MA plan bids are typically cheaper than Traditional Medicare (i.e., MA plans are more cost effective), Medicare does not realize these cost savings – those cost savings are shared by the specific plans and their enrollees, in the form of extra benefits.13 In fact, Medicare spends 22% more on MA enrollees than on Traditional Medicare enrollees, an $83 billion annual difference.14

CMS’s 2026 Rate Announcement will increase payments to MA plans by 5.06%, a $25 billion increase.15 The annual payment update is a sum of the percentage impact of various “policy changes and updates on MA plan payment parameters relative to last year,” including:

-

The effective growth rate, which is updated annually according to statute, “represents the average expected change in benchmarks…based on the growth in Medicare per capita costs.”16 For 2026, that percent impact is estimated to be 9.04% (much higher than the proposed 5.93%), due to the final calculation’s inclusion of data through the fourth quarter of 2024.

-

Rebasing/re-pricing, which is based on the average geographic adjustment index and is estimated at -0.28% for 2026.

-

Change in MA Star Ratings, which “reflects the estimated effect of changes in the Quality Bonus Payments for the upcoming payment year.” This change is estimated to be -0.69% for 2026.

-

Risk model revision and FFS normalization, which reflects the impact of the update to the FFS normalization factors for MA risk adjustment. This combined impact is estimated to be a change of -3.01% for 2026.17

CMS explained that the significant increase in payment rates between the proposed and final announcements is due to the utilization of more recent data in its calculation, which reflects higher Medicare spending (the starting point for MA benchmarks).18 However, industry analysts have noted that the actual MA rate increase for 2026 will be even greater – approximately 7.2% – due to the impact of risk scoring changes, as the payment update “does not include an adjustment for underlying coding trend in MA,” i.e., the documentation of more/higher-acuity care by MA plans,19 which CMS expects will increase risk scores by 2.1%.20

In 2024, CMS finalized an updated Risk Adjustment Model, called the 2024 CMS-HCC model, to be phased in over three years.21 The third and final year of that phase-in will be 2026 , during which CMS will calculate 100% of the MA plans’ risk scores using solely the 2024 CMS-HCC model (in previous years CMS used a hybrid approach with both the new and old models).22

Most in the healthcare industry anticipated that the Trump Administration would act favorably toward MA plans, given CMS Administrator Dr. Mehmet Oz’s previously expressed support for MA generally, as well as for more investment in the program.23 However, this increase may have exceeded even the most optimistic expectations, as MA insurer stock prices soared following the announcement.24 As the Trump Administration and Capitol Hill continue their push to cut federal spending in the healthcare industry,25 it now appears clear that the MA program will not be part of that conversation.

“CMS Finalizes 2026 Payment Policy Updates for Medicare Advantage and Part D Programs” Centers for Medicare & Medicaid Services, April 7, 2025, https://www.cms.gov/newsroom/press-releases/cms-finalizes-2026-payment-policy-updates-medicare-advantage-and-part-d-programs (Accessed 4/17/25).

“Trump’s CMS dramatically raises payments to Medicare Advantage plans” By Rebecca Pifer, Healthcare Dive, April 8, 2025, https://www.healthcaredive.com/news/medicare-advantage-2026-payment-rates-trump-humana-unitedhealth/744682/ (Accessed 4/17/25).

“Medicare Advantage Plans” Medicare.gov, https://www.medicare.gov/sign-upchange-plans/types-of-medicare-health-plans/medicare-advantage-plans (Accessed 4/18/25).

“Medicare Advantage in 2024: Enrollment Update and Key Trends” Kaiser Family Foundation, August 8, 2024, https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2024-enrollment-update-and-key-trends/ (Accessed 4/17/25).

Kaiser Family Foundation, August 8, 2024.

For more information on types of MA plans, please see “Valuation of MA Plans: Introduction & Competitive Environment” Health Capital Topics, Vol. 16, Issue 3 (March 2023), https://www.healthcapital.com/hcc/newsletter/03_23/HTML/PLANS/convert_val_ma_plans_intro_competiton.php (Accessed 4/17/25).

“Medicare Advantage Program Payment System” Medicare Payment Advisory Commission, October 2024, https://www.medpac.gov/wp-content/uploads/2024/10/MedPAC_Payment_Basics_24_MA_FINAL_SEC.pdf (Accessed 4/18/25).

For more information on Regional MA plans, see the first installment in this series: “Valuation of MA Plans: Introduction & Competitive Environment” Health Capital Topics, Vol. 16, Issue 3 (March 2023), https://www.healthcapital.com/hcc/newsletter/03_23/HTML/PLANS/convert_val_ma_plans_intro_competiton.php (Accessed 4/24/23).

Medicare Payment Advisory Commission, October 2024.

“Chapter 12: The Medicare Advantage program: Status report and mandated report on dual-eligible special needs plans” in “Report to the Congress: Medicare Payment Policy” Medicare Advisory Payment Commission, March 2022, available at: https://www.medpac.gov/wp-content/uploads/2022/03/Mar22_MedPAC_ReportToCongress_Ch12_SEC.pdf (Accessed 3/3/23), p. 411.

“Growth in Medicare Advantage Raises Concerns” By Paul N. Van de Water, Center on Budget and Policy Priorities, January 10, 2025, https://www.cbpp.org/research/health/growth-in-medicare-advantage-raises-concerns#:~:text=MA%20plans%20are%20substantially%20overpaid,%2483%20billion%20in%20annual%20spending. (Accessed 4/17/25).

2026 Medicare Advantage and Part D Rate Announcement” Centers for Medicare & Medicaid Services, April 7, 2025, https://www.cms.gov/newsroom/fact-sheets/2026-medicare-advantage-and-part-d-rate-announcement (Accessed 4/17/25).

“CMS Finalizes 2026 Payment Policy Updates for Medicare Advantage and Part D Programs” Centers for Medicare & Medicaid Services, April 7, 2025, https://www.cms.gov/newsroom/press-releases/cms-finalizes-2026-payment-policy-updates-medicare-advantage-and-part-d-programs (Accessed 4/17/25).

Centers for Medicare & Medicaid Services, April 7, 2025.

“Trump’s CMS dramatically raises payments to Medicare Advantage plans” By Rebecca Pifer, Healthcare Dive, April 8, 2025, https://www.healthcaredive.com/news/medicare-advantage-2026-payment-rates-trump-humana-unitedhealth/744682/ (Accessed 4/17/25).

“Medicare Advantage Payments to Increase Again” By Jeannie Fuglesten Biniek, Kaiser Family Foundation, Quick Takes, April 9, 2025, https://www.kff.org/quick-take/medicare-advantage-payments-to-increase-again/ (Accessed 4/17/25).

Centers for Medicare & Medicaid Services, April 7, 2025; Pifer, Healthcare Dive, April 8, 2025.

Centers for Medicare & Medicaid Services, April 7, 2025.

“Democrats question Oz over Medicare Advantage advocacy, UnitedHealth stock” By Emily Olsen, Healthcare Dive, December 12, 2024, https://www.healthcaredive.com/news/democrats-criticize-oz-cms-administrator-pick-medicare-advantage-warren-wyden/735262/ (Accessed 4/17/25).

“Health Insurer Stocks Soar on Medicare Rate Boost” By Anna Wilde Mathews, The Wall Street Journal, April 8, 2025, https://www.wsj.com/health/healthcare/private-medicare-plans-to-get-big-payment-boost-from-trump-administration-017d9aaa?mod=health_lead_pos1&utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosvitals&stream=top (Accessed 4/17/25).

“Leaked HHS budget signals $40B in cuts, assumes ACA subsidies expire” By Noah Tong, Fierce Healthcare, April 17, 2025, https://www.fiercehealthcare.com/regulatory/hhs-budget-slashed-40-billion-first-look-hhs-reorganization-leaked-document (Accessed 4/17/25).