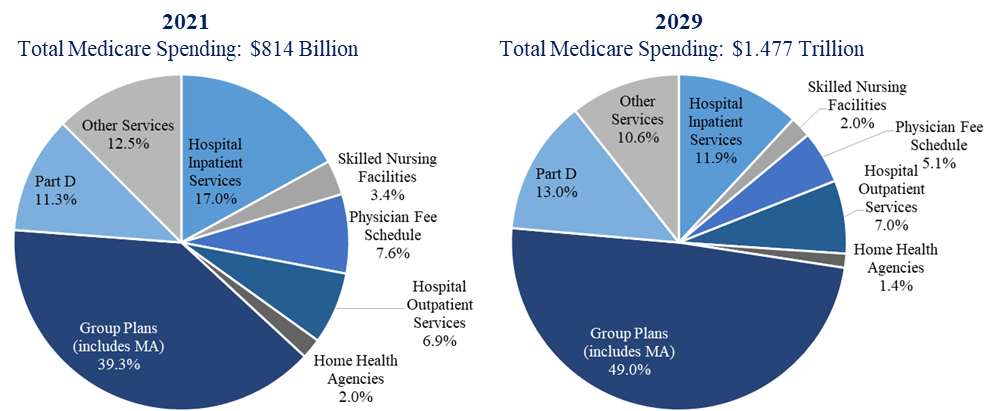

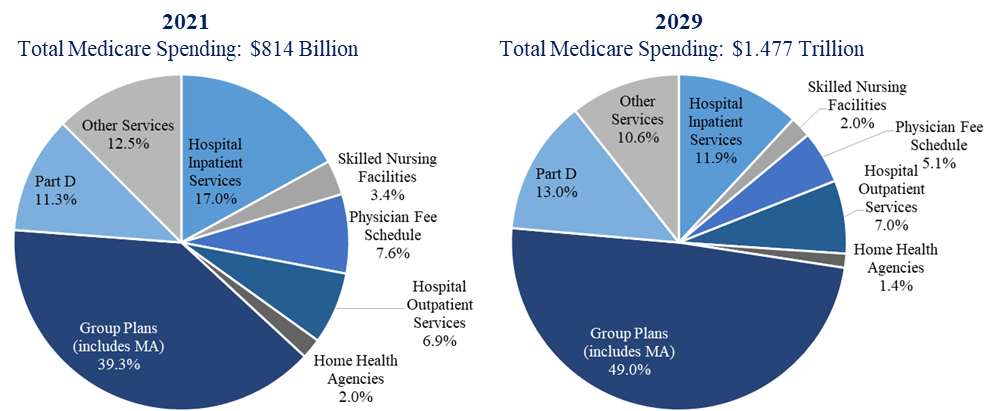

As noted in the first installment of this three-part series on the valuation of Medicare Advantage (MA) plans, Medicare enrollment is expected to increase significantly over the next several years. As a result, Medicare spending is expected to nearly double over the same time frame.1 As illustrated in Exhibit 1, group plans (which are largely comprised of MA plans) received 35% of all Medicare spending in 2021. That proportion is projected to grow to 49% by 2029:

Medicare Spending Categories, 2021 and 20292

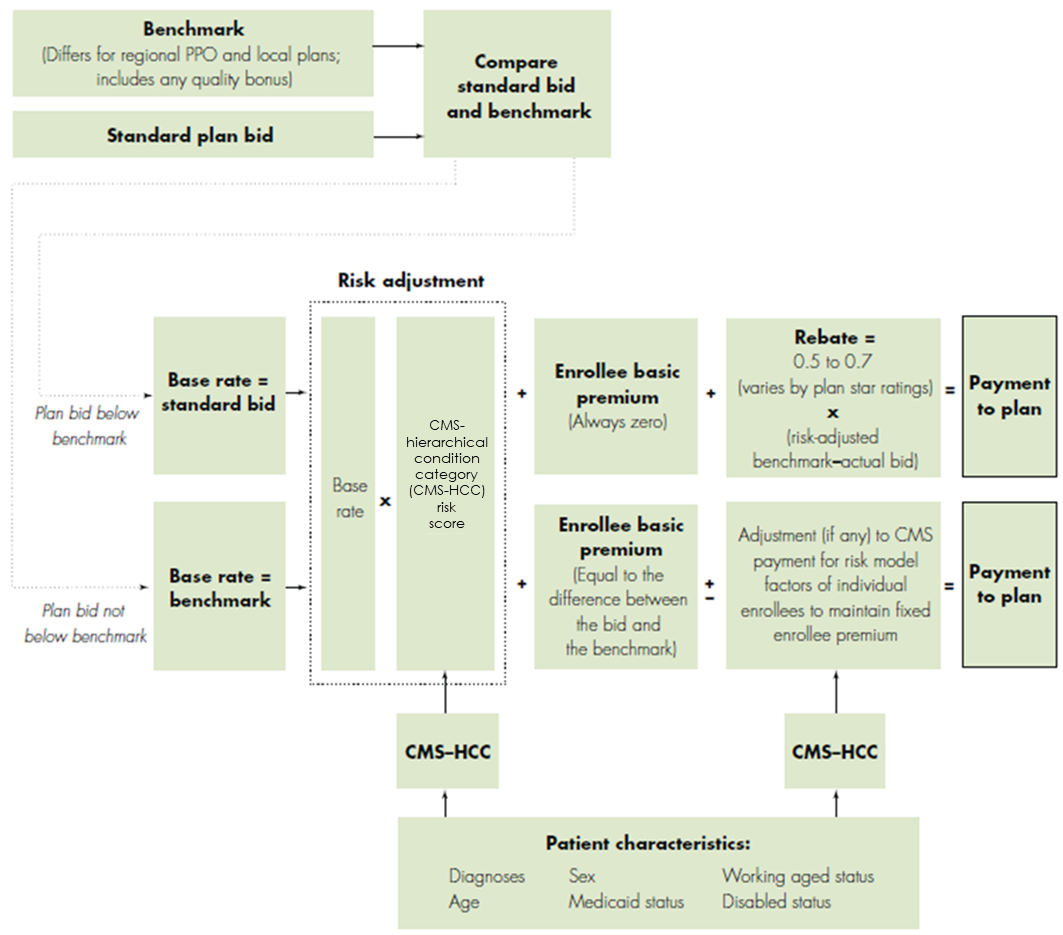

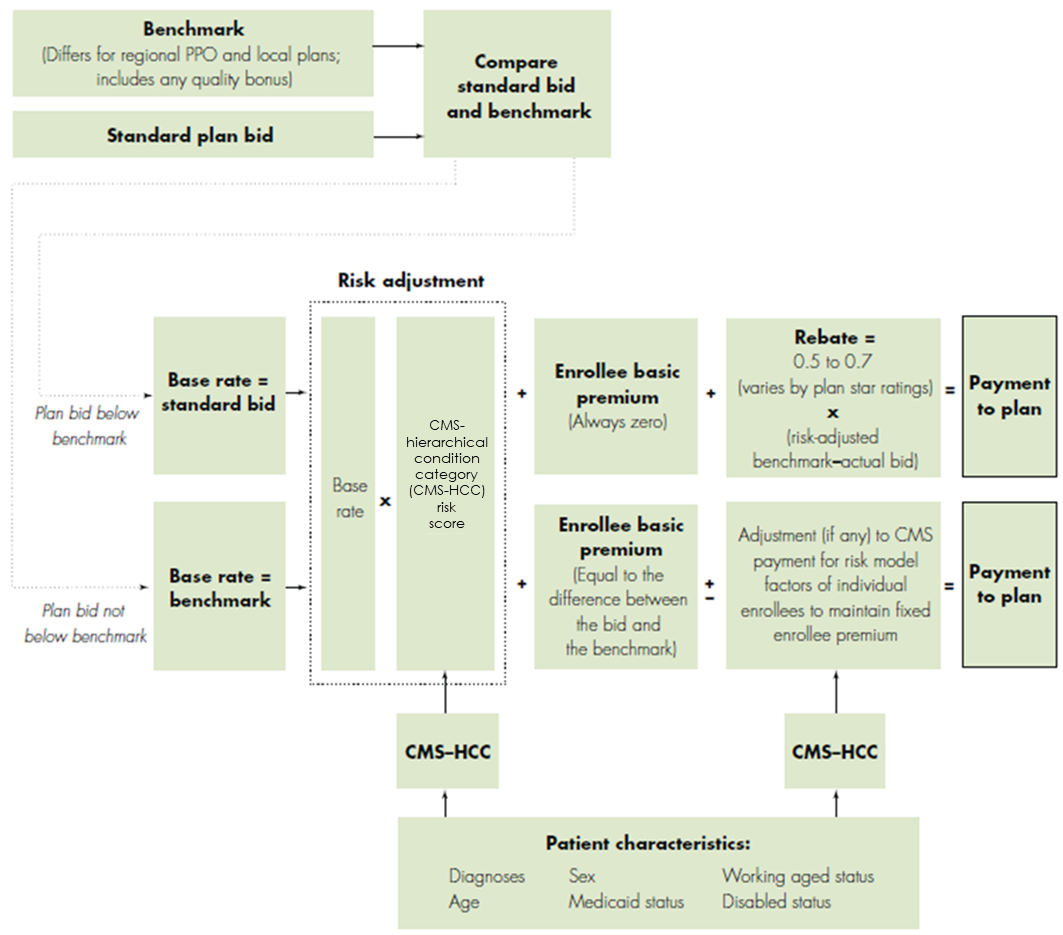

Medicare reimburses Local MA plans (a type of MA plan that can take a number of different forms, and serve one or more counties3) a fixed amount (capitated payment) per month. That amount is determined annually, based on a combination of:

The plan’s annual bid, in which they propose to Medicare the amount it would take to cover an average beneficiary, including administrative costs and the plan’s profit;

The bid is compared to the local benchmark, which looks at average fee-for-service (FFS) spending per Medicare beneficiary in each county. Plans are then assigned to a benchmark based on FFS spending in the counties at issue in the previous year (those counties with higher spending are assigned lower benchmarks);

The plan’s Medicare star ratings; and,

The plan’s patient geographic and health risk characteristics.

4

If the plan’s bid is above the benchmark, “the plan receives a monthly base payment equal to the benchmark and its enrollees have to pay an additional premium.” If the plan’s bid is the same as the benchmark, the plan is paid a monthly base payment equal to the benchmark. If the plan’s bid is lower than the benchmark, the plan receives a monthly base rate equal to its bid, plus a “rebate” equal to a portion of the difference between the bid and the benchmark.5

MA Payment System for Local Plans6

Note that this payment methodology only applies to Part A and Part B services; plans with Part D prescription drug benefits must submit a separate bid for that portion.7

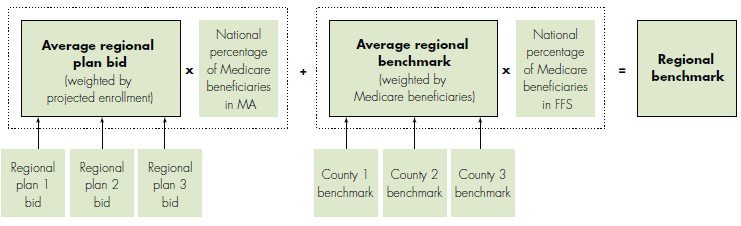

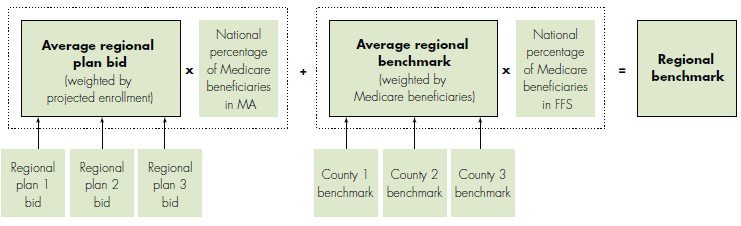

The payment methodology for regional MA plans (preferred provider organizations that serve all of a region designated by the Centers for Medicare & Medicaid Services [CMS]8) is more complex in that the benchmark formula includes the bids submitted by MA plans, as shown in the below schematic:

MA Payment System for Regional Plans9

Notably, although MA plan bids are typically cheaper than Traditional Medicare (i.e., MA plans are more cost effective), Medicare does not realize these cost savings – those cost savings are shared by the specific plans and their enrollees, in the form of extra benefits.10 In fact, Medicare spends approximately 6% more on MA beneficiaries than on Traditional Medicare enrollees (up from a 4% in 2022), which is the antithesis of the reason for MA’s establishment.11 For that reason, the Medicare Payment Advisory Commission (MedPAC) has strongly urged CMS to apply “appropriate financial pressure similar to…providers in the traditional FFS program”12 and even proposed specific changes to MA benchmark calculations in an effort to reduce MA payments.13

MA plans may be more cost effective than Traditional Medicare in part due to their leveraging of digital solutions to engage current members and attract new members. These efforts were accelerated by the COVID-19 pandemic, as MA plans sought to keep patients at home and cared for.14 Perhaps the most important digital solution being embraced by MA plans is telehealth. A Deloitte analysis found that more MA members used telehealth in the first four months of 2020 than in all of 2019.15 As a result of this dramatic shift toward the use of telehealth, those that do not have the technology are expected to be at a competitive disadvantage going forward. In fact, as of 2023, 97% of individual MA plans offer telehealth benefits, 75% offer remote access technologies, and 3% offer telemonitoring services.16

Particularly because of the patient demographics of those enrolled in MA plans (i.e., age 65 and older), plans are also ensuring that the technology is accessible. Toward that end, MA organizations (MAOs) are offering step-by-step instructions and helplines to assist members in utilizing the technology, and increasing access by providing hot spots that plan members can use to access Wi-Fi and join telehealth appointments.17 Facilitating these efforts, CMS revised MA rules in April 2020 so that plans may now provide smartphones or other video devices (as a supplemental benefit) for members to use for their telehealth visits.18

As noted above, while MA plans have shown the ability to provide care more efficiently than Traditional Medicare, and plan bids are consistently chapter than Traditional Medicare, Medicare spends 6% more per MA enrollee, “a difference that translates into a projected $27 billion in 2023.”19 As a result, MedPAC has called for “a major overhaul of MA policies is urgently needed to reduce the gap between MA and FFS payment,”20 a request that would necessitate regulatory action and increased oversight. The current state of regulatory enforcement of MA plans will be addressed in the last installment of this three-part series.

“Medicare Data Hub” The Commonwealth Fund, October 2020, available at: https://www.commonwealthfund.org/sites/default/files/2020-10/Medicare%20Data%20Hub_October2020.pdf (Accessed 3/3/23), p. 4.

“Baseline Projections” Congressional Budget Office, May 2022, available at: https://www.cbo.gov/system/files/2022-05/51302-2022-05-medicare.pdf (Accessed 3/3/23).

For more information on Local MA plans, see the first installment in this series: “Valuation of MA Plans: Introduction & Competitive Environment” Health Capital Topics, Vol. 16, Issue 3 (March 2023), https://www.healthcapital.com/hcc/newsletter/03_23/HTML/PLANS/convert_val_ma_plans_intro_competiton.php (Accessed 4/24/23).

“Medicare Advantage Program Payment System” Medicare Payment Advisory Commission, Payment Basics, November 2021, p. 3.

Ibid, p. 1; “Higher and Faster Growing Spending Per Medicare Advantage Enrollee Adds to Medicare's Solvency and Affordability Challenges” By Jeannie Fuglesten Biniek, et al., Kaiser Family Foundation, August 17, 2021, https://www.kff.org/medicare/issue-brief/higher-and-faster-growing-spending-per-medicare-advantage-enrollee-adds-to-medicares-solvency-and-affordability-challenges/ (Accessed 3/3/23).

CMS-HCC = CMS-hierarchical condition category. “Medicare Advantage Program Payment System” Medicare Payment Advisory Commission, Payment Basics, November 2021, p. 2.

Medicare Payment Advisory Commission, Payment Basics, November 2021, p. 3.

For more information on Regional MA plans, see the first installment in this series: “Valuation of MA Plans: Introduction & Competitive Environment” Health Capital Topics, Vol. 16, Issue 3 (March 2023), https://www.healthcapital.com/hcc/newsletter/03_23/HTML/PLANS/convert_val_ma_plans_intro_competiton.php (Accessed 4/24/23).

CMS-HCC – CMS-hierarchical condition category. “Medicare Advantage Program Payment System” Medicare Payment Advisory Commission, Payment Basics, November 2021, p. 3-4.

“Chapter 12: The Medicare Advantage program: Status report and mandated report on dual-eligible special needs plans” in “Report to the Congress: Medicare Payment Policy” Medicare Advisory Payment Commission, March 2022, available at: https://www.medpac.gov/wp-content/uploads/2022/03/Mar22_MedPAC_ReportToCongress_Ch12_SEC.pdf (Accessed 3/3/23), p. 411.

Ibid, p. 411; “Chapter 11: The Medicare Advantage program: Status report” in “Report to the Congress: Medicare Payment Policy” Medicare Advisory Payment Commission, March 2023, available at: https://www.medpac.gov/wp-content/uploads/2023/03/Ch11_Mar23_MedPAC_Report_To_Congress_SEC.pdf (Accessed 4/24/23), p. 322.

Medicare Advisory Payment Commission, March 2022, p. 412.

“Report to the Congress: Medicare and the Health Care Delivery System” Medicare Payment Advisory Commission, June 2021, available at: https://www.medpac.gov/wp-content/uploads/import_data/scrape_files/docs/default-source/reports/jun21_medpac_report_to_congress_sec.pdf (Accessed 3/3/23), p. 3-45.

“Leveraging digital solutions to engage, attract, and retain Medicare Advantage members” By Leslie Reed, et al., Deloitte Insights, October 8, 2022, https://www2.deloitte.com/us/en/insights/industry/health-care/medicare-advantage-telehealth.html (Accessed 3/3/23).

“Medicare Advantage 2023 Spotlight: First Look” Kaiser Family Foundation, November 10, 2022, https://www.kff.org/medicare/issue-brief/medicare-advantage-2023-spotlight-first-look/ (Accessed 3/3/23).

“Incorporating modern technology benefits into Medicare Advantage plans” By Kishlay Anand, Physicians Practice, February 10, 2021, https://www.physicianspractice.com/view/incorporating-modern-technology-benefits-into-medicare-advantage-plans (Accessed 3/3/23).

Reed, et al., Deloitte Insights, October 8, 2022.

Medicare Advisory Payment Commission, March 2023, p. 322.