Diagnostic imaging centers operate in a highly competitive environment with other providers of diagnostic imaging, such as hospitals and physician offices.1 While hospitals may have some competitive advantages over freestanding imaging centers (e.g., location, wherein the patient is already admitted to the hospital and the reading radiologist is on-site), imaging centers have become more desirable by both patients, who find the freestanding locations to be more convenient, and payors, who find services at freestanding locations to be less expensive than those performed in the hospital or a hospital outpatient department (HOPD). This second installment in a five-part series on the valuation of diagnostic imaging centers will discuss the competitive environment in which these centers operate.

Supply of Diagnostic Imaging Facilities

The level of competition in the diagnostic imaging center industry is high.2 As of 2022, there were over 9,769 diagnostic imaging centers in operation in the U.S., which number has declined by approximately 1.5% per year over the past five years.3 Cost pressures have strained the environment in which diagnostic imaging centers operate, with inflation and steady patient volumes making it a challenge for centers to recoup profit, and consequently chilling the growth in the number of centers.4 Nevertheless, competition is expected to remain high going forward, and the number of diagnostic imaging centers is anticipated to remain relatively stagnant over the next five years, increasing an annual rate of only 0.4%.5 Due to factors such as imaging technology advancement and increased demand for diagnostic imaging services, imaging volumes have risen from over 115 million scans in 2012 to an estimated 120 million in 2019, with PET showing the most growth.6

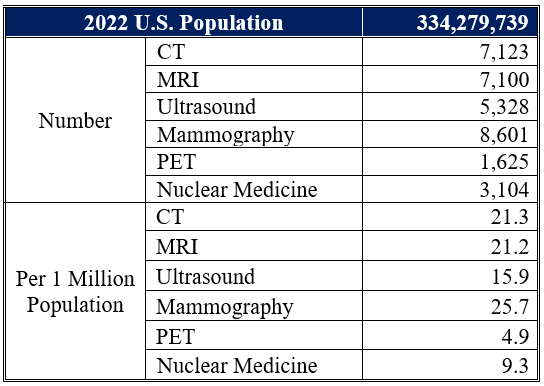

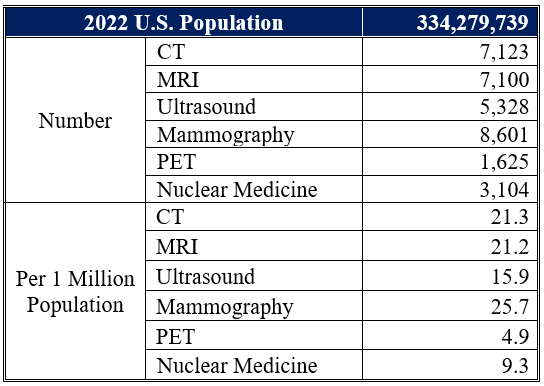

The number of various types of modalities in the U.S. accredited by the American College of Radiology (ACR) is set forth below in Table 1.

Table 1: Number of ACR-Accredited Diagnostic Imaging Modalities7

Demand for Diagnostic Imaging Services

The key drivers in the supply of diagnostic imaging facilities are largely attributable to an aging population, increases in chronic disease, the need for accessible and timely care, and advancements in technology.

One of the most important factors affecting demand for imaging procedures, and healthcare overall, is the aging Baby Boomer population. By 2030, all Baby Boomers will be age 65+, and by 2034, will outnumber children for the first time in U.S. history.8 Approximately 20-30% of those age 65+ who fall suffer from moderate to severe injuries such as hip fractures or head trauma, potentially requiring the use of CT or MRI scans to diagnose the injury.9 Additionally, with increases in chronic disease, medical imaging that can provide safe treatments and quick diagnosis is necessary now more than ever.10 It is estimated that between 2020 and 2050, the number of individuals over the age of 50 with at least one chronic disease will increase nearly 100%, and those with multiple chronic diseases will increase over 91%.11

Technological advances, including those that have shrunk the size of medical imaging devices, have increased the accessibility of imaging, giving patients more location options than just hospital imaging departments.12 Smaller and (thus portable) devices are more affordable, increasing accessibility for practitioners,13 and allow scans to be done in other types of locations, helping to answer patient questions and provide early detection.14

Other advances in technology, such as artificial intelligence (AI), are also expected to drive growth in the diagnostic imaging market, as it could help guide practitioners around anatomy and change depth and contrast on an image automatically.15 These features can lower the barrier to entry for providers who have never used medical imaging before, and allow them to use devices with accurate readings from the start.16 While doctors are still required by the Food and Drug Administration (FDA) to provide the final reading on images, the FDA has already approved more than 400 AI algorithms that can scan for a variety of diseases with an 80-90% accuracy rate.17

Detailed imaging is required not only to diagnose cancer, but also to plan cancer treatment and determine if that treatment is successful.18 As a result, imaging procedure growth is linked in part to the diagnosis of many diseases associated with later age, including cancer, so the incidence of cancer, for which a number of diagnostic imaging modalities are used to diagnose and treat, also drives demand for diagnostic imaging.19 An estimated 1.9 million new cancer cases were diagnosed in 2022, and cancer incidence is expected to increase in the future.20 As the U.S. population ages, the number of new cancer cases will also increase,21 increasing the need for screening services, particularly CT scans, which are typically used for tumors and cancer monitoring.22 Additionally, mammography utilization may increase due to projected trends in breast cancer, as mammography demand rises with increases in cancer incidence and as the population ages (as age is one of the main risk factors for breast cancer).23 Approximately 1 in 8 American women will develop breast cancer during her life, indicating that the need for mammography scans will continue, and potentially increase, in the future.24

Over the next few years, diagnostic imaging centers may benefit from: (1) increased demand for services due to the aging Baby Boomer population, who will require more diagnostic imaging services; and (2) a patient and payor preference for diagnostic imaging conducted in freestanding centers (in contrast to the hospital or HOPD setting). However, this growth in demand (i.e., the quantity of scans performed) may be tempered by decreasing Medicare reimbursement for diagnostic imaging. The next installment in this five-part series will review the reimbursement environment in which diagnostic imaging centers operate.

“Diagnostic Imaging Centers Industry in the US” By Marley Brocker, IBISWorld, February 2024, p. 12.

“Healthcare Utilisation: Diagnostic Exams” Organisation for Economic Co-Operation and Development, https://stats.oecd.org/index.aspx?DataSetCode=HEALTH_STAT# (Accessed 11/3/23).

“Accredited Facility Search” American College of Radiology, https://www.acraccreditation.org/accredited-facility-search (Accessed 11/1/23); “Pop-Facts Demographic Snapshot: United States” Environics Analytics, 2022.

“Older People Projected to Outnumber Children for First Time in U.S. History” United States Census Bureau, March 13, 2018, Revised October 8, 2019, https://www.census.gov/newsroom/press-releases/2018/cb18-41-population-projections.html (Accessed 11/1/23).

“Falls” World Health Organization, April 26, 2021, https://www.who.int/news-room/fact-sheets/detail/falls (Accessed 11/1/23).

“The Drivers Of Medical Imaging Market Growth And Where Tech Leaders Fit In” By Ohad Arazi, Forbes, September 26, 2023, https://www.forbes.com/sites/forbestechcouncil/2023/09/26/the-drivers-of-medical-imaging-market-growth-and-where-tech-leaders-can-fit-in/?sh=65deac9c2988 (Accessed 3/13/24).

“Cancer Diagnostic Imaging” University of Rochester Medical Center, https://www.urmc.rochester.edu/encyclopedia/content.aspx?contenttypeid=85&contentid=p07178 (Accessed 11/1/23).

“Baby Boomers: The Radiological Outlook” By Cat Vasko, Radiology Business, April 23, 2014, https://www.radiologybusiness.com/topics/care-delivery/baby-boomers-radiological-outlook (Accessed 11/1/23); “Baby Boomers and Breast Cancer: When Can I Stop Getting Mammograms?” Center for Diagnostic Imaging, November 9, 2016, https://www.mycdi.com/viewpoints/baby_boomers_and_breast_cancer_when_can_i_stop_getting_mammograms_154 (Accessed 11/1/23).

“Cancer Facts & Figures: 2022” American Cancer Society, 2022, https://www.cancer.org/content/dam/cancer-org/research/cancer-facts-and-statistics/annual-cancer-facts-and-figures/2022/2022-cancer-facts-and-figures.pdf (Accessed 11/1/23), p.1.

“Age and Cancer Risk” National Cancer Institute, https://www.cancer.gov/about-cancer/causes-prevention/risk/age (Accessed 11/1/23).

“Age and Cancer Risk: A Potentially Modifiable Relationship” By Mary C. White, et al., American Journal of Preventative Medicine, Vol 46, No. 3 Suppl 1 (March 2014), p. 1; “CT Scan vs. MRI” Healthline, https://www.healthline.com/health/ct-scan-vs-mri (Accessed 11/1/23).

“Breast Cancer Risk Factors” Breastcancer.org, https://www.breastcancer.org/risk/factors (Accessed 11/1/23); “Tomosynthesis market healthy and only getting stronger” By Dave Pearson, Health Imaging, November 25, 2015, https://www.healthimaging.com/topics/breast-imaging/tomosynthesis-market-healthy-and-only-getting-stronger (Accessed 11/1/23).

“Get Tested for Breast Cancer” healthfinder.gov, https://healthfinder.gov/HealthTopics/Category/doctor-visits/screening-tests/get-tested-for breast-cancer (Accessed 11/1/23).